ThryvPay Mobile Application Guide

ThryvPay Mobile Application Guide

Let’s activate your ThryvPay Account starting with your business information

Business Information

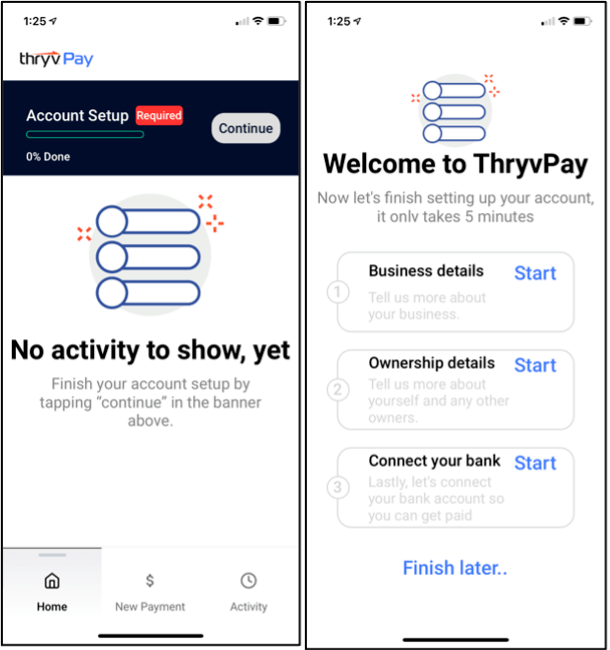

Click the Account Setup banner or the continue button.

- Start filling out your Business details by clicking Start.

- Select your business type; Sole Propriator, LLC, Partnership, Corp, Non Profit or Government.

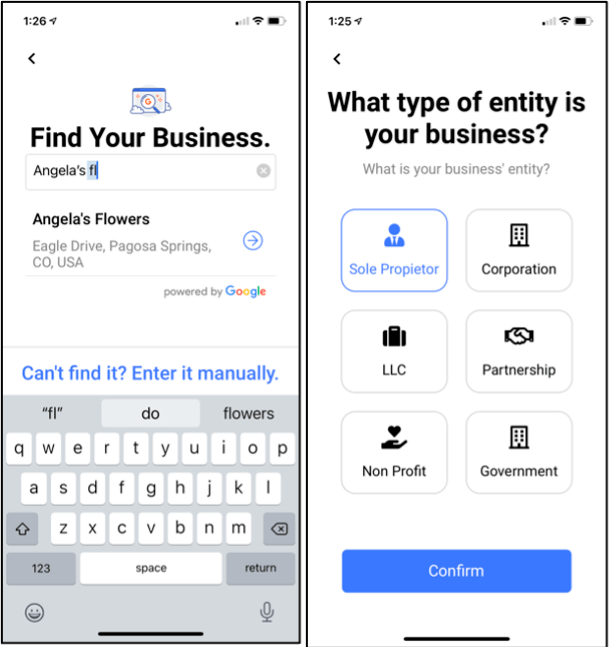

Now let’s search for your business using Google search…

- Start typing in your business name or phone number.

- Google will display all results related to that entry.

- Select your correct location.

- If you can’t find your business on Google, you may enter the information manually by clicking the Can’t find link on the bottom of the screen.

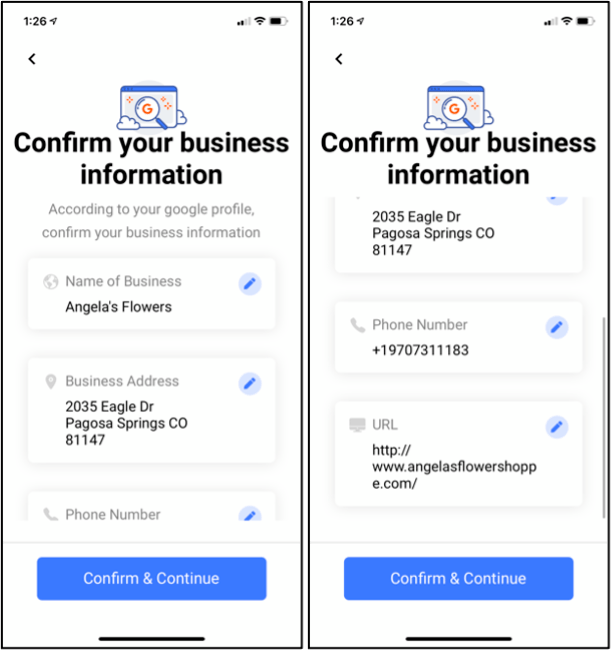

- Once you have selected your business, verify that all your information is correct.

- Click confirm & continue.

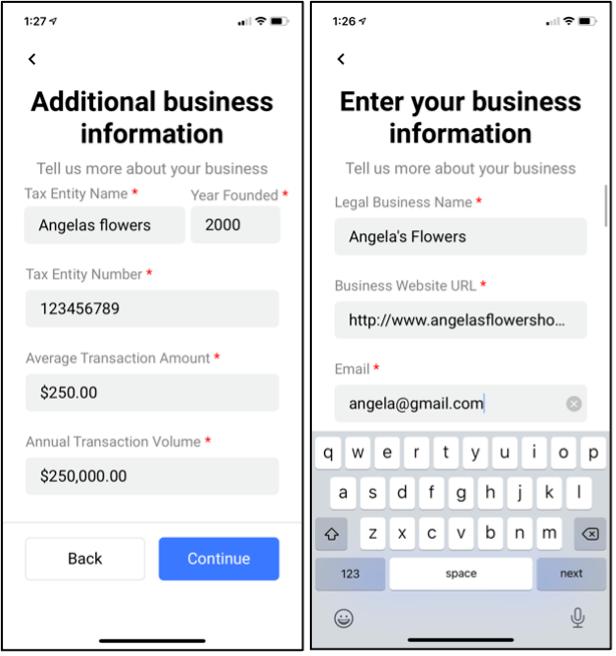

- Complete the additional questions about your business.

- Enter your business’ Legal or Tax Entity name. This is the name you file your business taxes under. If your business is a Sole Prop this is your first and last name.

- Enter the year your business started or opened.

- Enter your business TaxID number. This is the number you use for filing taxes. If your business is a sole prop, this is your Social Security Number.

- Enter your average transaction amount, this is the average amount of all of your services/payments, if you occasionally have larger transactions, enter the larger amount.

- Enter your Annual transaction volume assumption.

- Click continue.

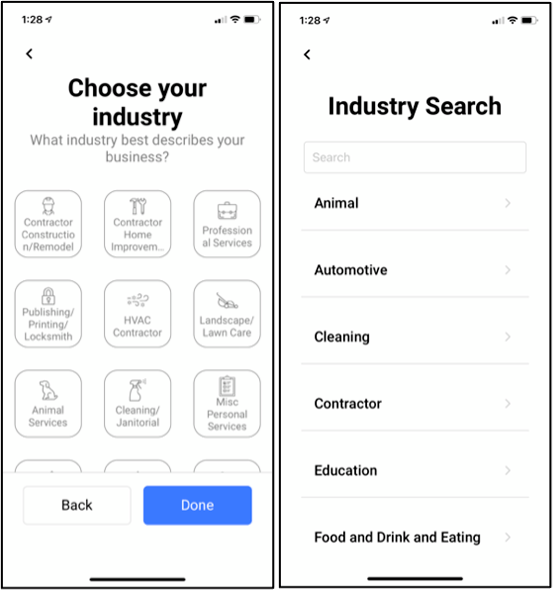

- Choose your industry type – this is the industry associated to your banking category MCC code.

- If you don’t see an exact match you can search additional industries by clicking the “can’t find” link at the bottom of the screen.

- Start typing in your category name, if still not found you may be considered either professional or personal services.

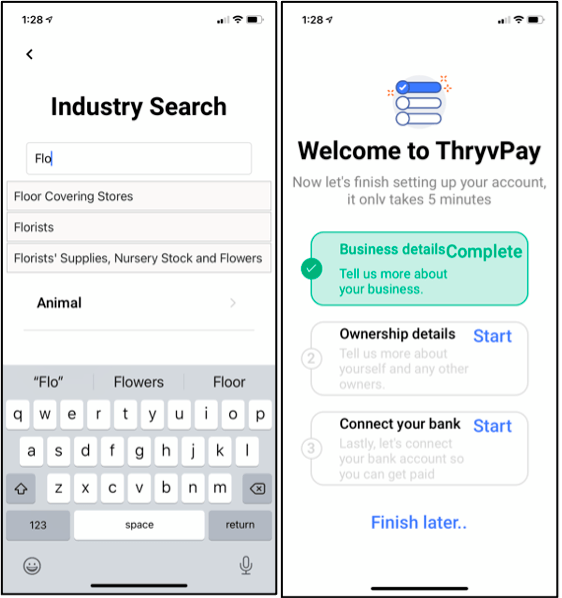

Awesome, your business details are now complete.

Owner Details

- Click on the Ownership details section.

- You will need to complete all the questions to submit your application.

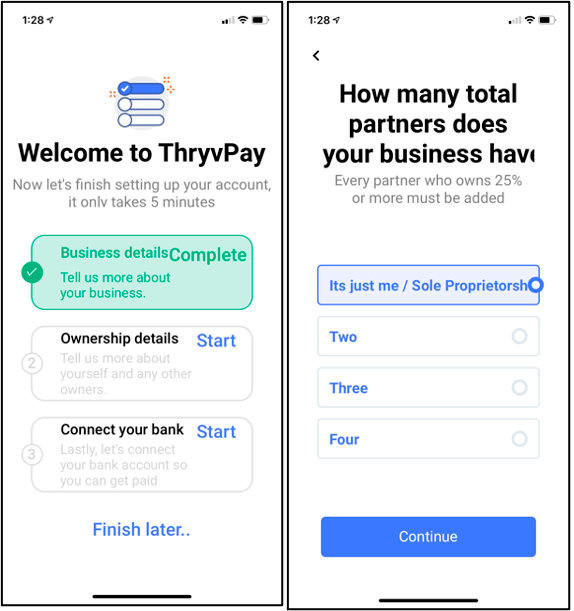

- How many partners/owners own more than 25% of your business, click continue.

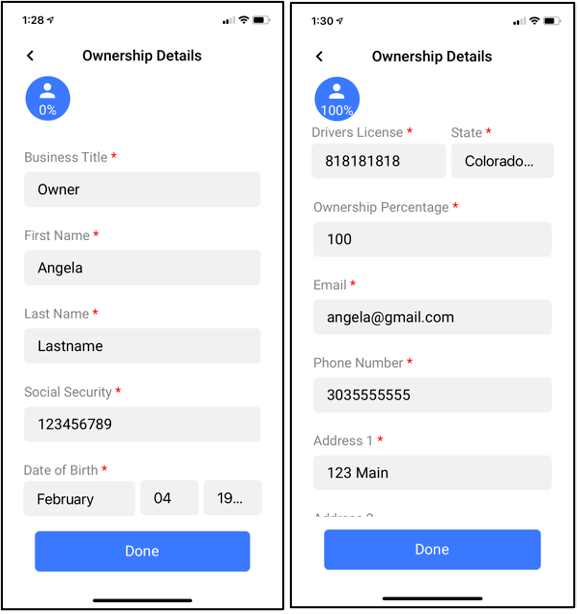

- Business title.

- Owner First and last name.

- Owner Social Security Number.

- Owner Date of Birth.

- Owner Driver’s license # and State.

- Ownership percent for that owner being listed.

- Owner Email.

- Owner Phone number.

- Owner Address, city, state, and zip.

- Click done!

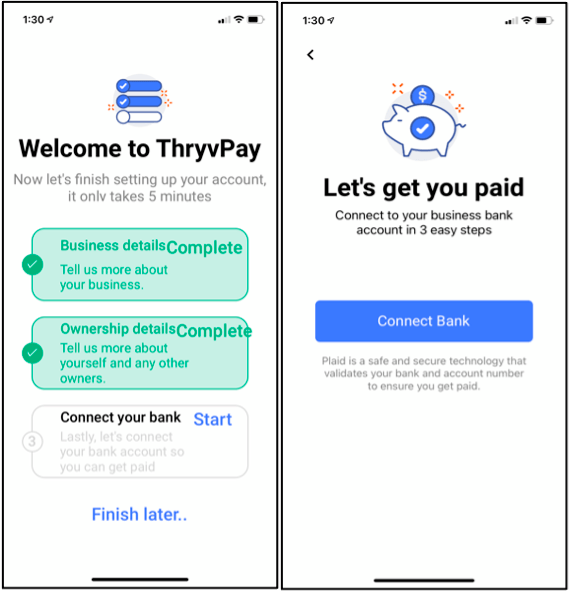

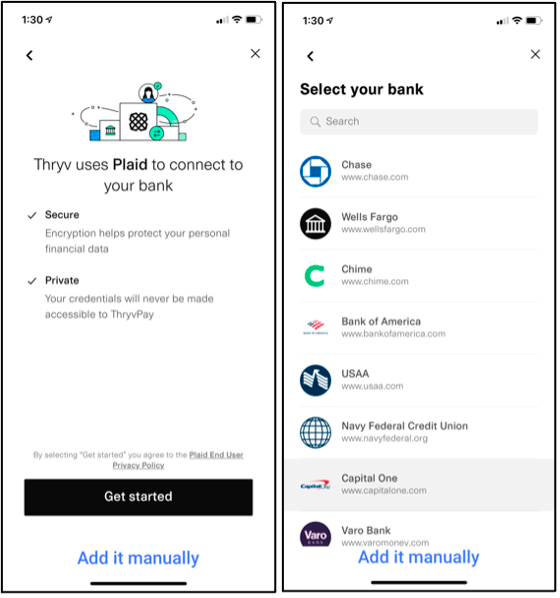

Connect Bank Account Via Plaid

Lastly, let’s connect your bank account via Plaid. For more information on Plaid click here.

- Click Connect Bank and then click Continue.

- Search for your bank by name, and click on the correct one.

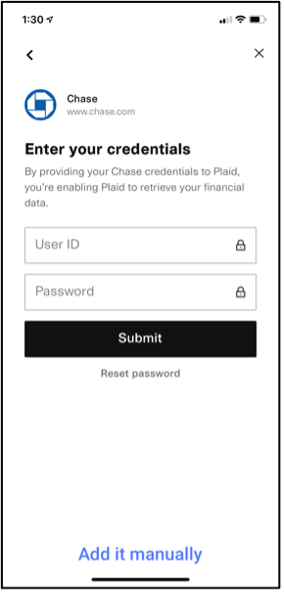

- Log in using your bank log in username and password.

- Select the business bank account you want to link to, click submit.

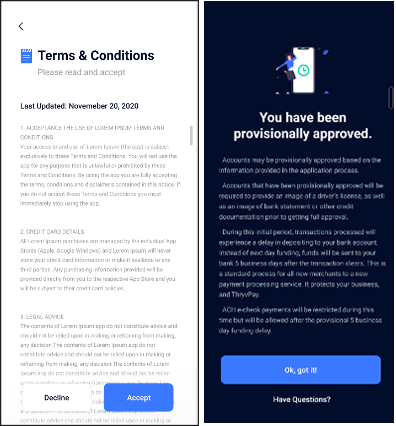

Finally, Complete the account set up and read and accept the ThryvPay Terms and Conditions.

- You will be required to upload an image of your Driver’s License prior to completing your application.

Congratulations! You are now provisionally approved.

Ready to create a payment request? Check out this article to find out how, create a payment request.

What does provisionally approved mean?

- Accounts may be provisionally approved based on the information provided in the application process.

- Accounts that have been provisionally approved will be required to provide an image of a driver’s license, as well as an image of bank statement or other credit documentation prior to getting full approval.

- During this initial period, transactions processed will experience a delay in depositing to your bank account. Instead of next day funding, funds will be sent to your bank 5 business days after the transaction clears. This is a standard process for all new merchants to a new payment processing service. It protects your business, and ThryvPay.

- ACH e-check payments will be restricted during this time but will be allowed after the provisional 5 business day funding delay.

- For more details on provisional approval click here

- Learn How to Process a Payment by clicking here

Didn’t get approved? Or have you been denied? You can contact ThryvPay@thryv.com to gather more detail regarding our decision. To see our restricted categories, click here.

Translate

Translate