ThryPay Mobile Overview

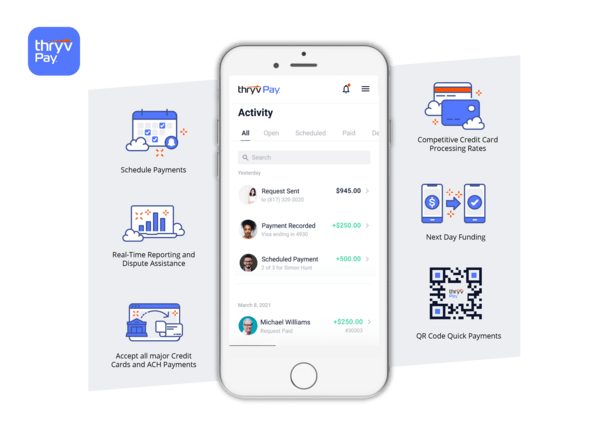

ThryvPay Mobile Overview

Don’t have a Thryv? That’s okay, you can sign up for ThryvPay payment processing for free today!

ThryvPay Mobile App, built specifically for service-based small businesses. Getting paid has never been easier! Whether you’re on the job, or on the go, accept payments, from any mobile device.

Safe. Secure. Contactless.

QR Code and instant payment requests made simple.

Provide convenience to your customers with QR code payments, and instant payment requests, right from your mobile phone.

Accept all major Credit Cards, and ACH payments, with just a few simple clicks.

Save thousands with competitive flat rates and no setup fees. Credit Card rates as low as 2.9% + .30 per transaction. ACH rates as low as $1 or 1% with a max of $9 for every transaction.

Accept tips and charge convenience fees to minimize cost.

Increase your profits for you and your staff by accepting tips, and charging optional flat rate convenience fees.

Guarantee available funds when accepting ACH payments.

ThryvPay partners with Plaid for fraud prevention, so you can be confident your customers have real-time funds available.

Offer convenience with Scheduled and Recurring Payments.

Offer your customers flexibility with scheduled automatic one-time, installments, custom or recurring Payments and build loyalty.

$1.00 fee per completed payment.

Create instant payment requests with your saved paid services.

Save time and stay organized by easily creating and saving customized services and products for quick selection when creating payment requests.

Real-time payment activity right at your fingertips.

Track and manage your payments and deposits including what’s pending, paid, and overdue in one place.

Next day funding for credit card payments.

Credit Card transactions made before 6pm EST are deposited the next business day.

ACH transactions can take 8-10 business days depending on the bank. Deposits incur a small fee of $0.30 per deposit.

Translate

Translate